capital gains tax services

Ad Smart Investing Can Reduce the Impact of Taxes On Investments. Contact a Fidelity Advisor.

Best Tax Consulting Sico Tax Tax Consulting Capital Gains Tax Tax Refund

Ad Thumbtack - find a trusted Accountant in minutes.

. C If you received any gains within twelve 12 months after the change of ownership of an asset same is deemed as part of the chargeable Income for Income Tax purposes. Subscribe to receive email or SMStext notifications about the Capital Gains tax. If you make a gain after selling a property youll pay 18 capital gains tax CGT as a basic-rate taxpayer or 28 if you pay a higher rate of tax.

If your taxable. Ad Infosys BPM partners with the Big Fours and tax tool providers for customized offerings. Ad Find Recommended Columbia Tax Accountants Fast Free on Bark.

The portion of any unrecaptured section 1250 gain from selling section. Capital Gains Tax Services Get suppliers exporters manufacturers and buyers of Capital Gains Tax Services in India and overseas. Departments agencies and public bodies.

As a non-resident you will pay tax on 100 of the capital gain from a property sale at 28. Free estimates no guessing. You are well served to work through your trusted tax.

You do not have to pay CGT if your gains for the tax year are below your yearly tax-free allowance. Detailed guidance regulations and rules. Washington DC home sellers need to understand how these rate limits on capital gains taxes will affect their investment.

Capital Gains Tax Services. They are subject to ordinary income tax rates meaning theyre. Get contact details email phone and address of.

Capital gains tax would be increased to 288 percent by house democrats. Contact a Fidelity Advisor. Depending on how long you hold your capital asset determines the amount of tax you will pay.

For the 20212022 tax year these tax rates are 10 18 for residential property for your entire capital gain if your overall annual income is below 50270. 4 rows The capital gains tax on most net gains is no more than 15 for most people. Strengthen internal controls and improve quality with the latest tax automation software.

The maximum net capital gain tax rate is 20 percent. Ad Smart Investing Can Reduce the Impact of Taxes On Investments. If you make a loss from the disposal then you set the loss against gains from another.

The 2021 Washington State Legislature recently passed ESSB 5096 RCW 8287 which creates a 7 tax. Calculating Capital Gains Tax. Capital Gains Tax is a tax on the profit when you sell or dispose of something an asset thats increased in value.

Capital Gains advice for non-residents in Portugal. A capital gain rate of 15 will apply should your. Capital Gains Tax Services.

First calculating capital gains tax can be very complicated. Capital gains from a mortgage foreclosure or a conditional sales repossession will be excluded from net income when calculating your claim for the goods and services taxharmonized sales. There is currently a bill that if passed would.

Short-term capital gain tax rates. Connect With Us 1350 Pennsylvania Avenue NW Suite 203 Washington DC 20004 Phone. When you sell your business the tax on the increased value of your business is called capital gains tax.

Connect with a Accountant instantly. Our capital gains tax service is designed to maximise specific reliefs and exemptions provided for in tax legislation and our services include the following. Capital gains provide an excellent opportunity for proactive tax planning due to a variety of minimizationtax elimination strategies available in the tax code.

Compare - Message - Hire - Done. Visit our Contact page for a map. In cases where you.

News stories speeches letters and notices. Capital Gains Tax CGT Capital Gains Tax is a tax on the profit you make from disposing of your asset. Net capital gains from selling collectibles such as coins or art are taxed at a maximum 28 rate.

Its the gain you make thats taxed not the. 20 28 for residential property. Then there is the bad news and its two fold.

Short-term capital gains are gains apply to assets or property you held for one year or less. ICE Data Servicess Capital Gains Tax CGT services can help to improve the efficiency of the day-to-day work carried out by accountants tax professionals. Capital gains tax CGT is a tax on the profit or gain you make when selling an asset.

Call us 353 21 4641400 Contact Us. However for most taxpayers a zero or 15 percent rate will. The capital gains tax rate usually depends on your income.

For UK residents the gain would also be taxable in. Gains from selling other assets are charged at. Capital Tax and Financial Services Inc.

Capital Gains Tax Monitoring Mitigating tax risks for investment funds The management of tax risks is also important for investment funds as not booking adequate tax provisions can result.

Alankit Uae Tax Refund Financial Accounting Firms

Cryptocurrency And Taxes Virtual Currency Income Tax Preparation Capital Gains Tax

Fillable Form 2438 Tax Forms Fillable Forms Form

Pin By Bhagath Reddy On Kros Chek Tax Services Income Tax Filing Taxes

Pin By Eztax In Free It Gst Filing On Income Tax Filing Software Expert Services Filing Taxes Income Tax Return Income Tax

How To Reduce Or Avoid Capital Gains Tax On Property Or Investments In 2021 Capital Gains Tax Capital Gain Tax Forms

Tax Preparation Service Now Income Tax Service Tax Preparation Tax Services Tax Preparation Services

Tax Compliance Calendar For Fy 2019 20 It Gst Tds Eztax In Filing Taxes Tax Services Compliance

5 Things Your Competitors Can Teach You About Income Tax Paysquare Tax Accountant Tax Services Capital Gains Tax

Section 721 Exchange Capital Gains Tax Real Estate Investment Trust Capital Gain

Understand Form 16 Itr Form 16 Filing Taxes Income Tax Return Tax Services

Income Tax Return Services Income Tax Return Income Tax Tax Return

Guide To Capital Gain What Is Capital Capital Gain Tax Preparation

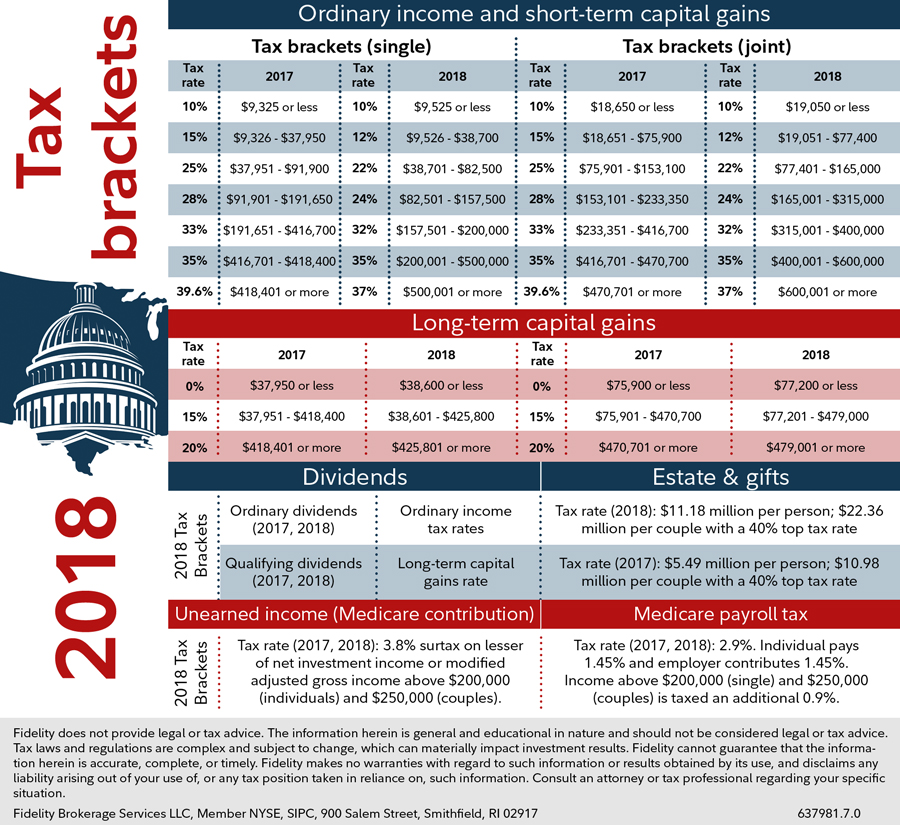

Pin By Jackie Kittle On Financials Tax Brackets Capital Gains Tax Capital Gain

The Beginner S Guide To Capital Gains Tax Infographic Transform Property Consulting Capital Gains Tax Capital Gain Investment Property

Doing Your Own Taxes Isn T As Hard As You D Think Mustard Seed Money Tax Deductions Tax Services Tax Return

Reap The Benefits Of Tax Loss Harvesting To Lower Your Tax Bill Investing Income Tax Preparation Capital Gains Tax

7 Things About Capital Gains In 2021 Real Estate Investor Capital Gains Tax Capital Gain

The Spectrum Of Clients And Indeed Our Experience Is Wide And Varied As A Result Of Supporting Sole Traders Tax Advisor Capital Gains Tax Chartered Accountant