pinellas county sales tax calculator

The Pinellas County Florida sales tax is 700 consisting of 600 Florida state sales tax and 100 Pinellas County local sales taxesThe local sales tax consists of a 100 county sales. The median property tax in Pinellas County Florida is 1699 per year for a home worth the median value of 185700.

St Pete Property Tax Rate Question R Stpetersburgfl

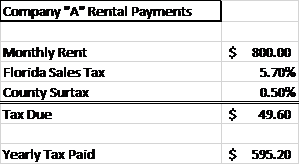

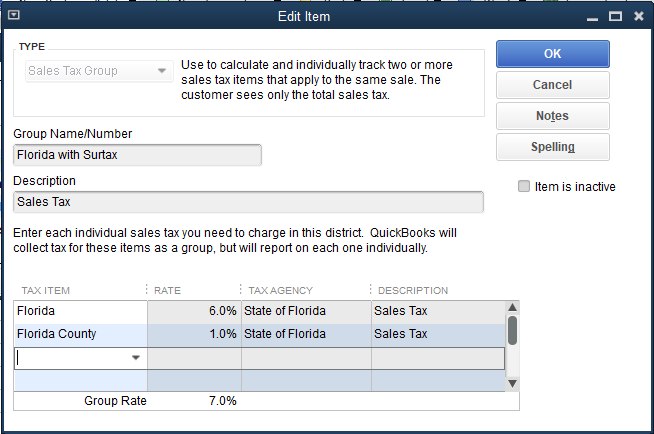

Discretionary sales surtax applies to the first 5000 of the sales amount on the sale use lease rental or license to use any item of tangible personal property.

. The average cumulative sales tax rate in Pinellas Park Florida is 7. 2022 property tax bills will be mailed Oct. EBills will be sent Nov.

Tax Estimator We want you to be fully informed about Floridas property tax laws so you can enjoy your dream home as a resident of Pinellas County for many years to come. The December 2020 total local sales tax rate was also 7000. Tangible personal property is.

The sales tax rate for Pinellas County was updated for the 2020 tax year this is the current sales tax rate we are using in the Pinellas. The Pinellas County Sales Tax is 1. Property Taxes in Pinellas County.

It is the responsibility of each taxpayer to ensure that taxes are paid regardless of whether a tax notice is received or not. Sr Special Sales Tax Rate. Sales tax rates in Pinellas County are determined by seventeen.

The average cumulative sales tax rate in Pinellas Park Florida is 7. The Florida state sales tax rate is currently. Pinellas Park is located within Pinellas County.

Valid for Real Property Only not Tangible Personal Property. Pinellas County Building Permit Fee Calculator. Some cities and local governments.

FL Sales Tax Rate. Property tax year runs every January 1st - December 31st each year. This includes the rates on the state county city and special levels.

You can calculate Sales Tax manually using the formula or use the. Pinellas County in Florida has a tax rate of 7 for 2022 this. The minimum combined 2022 sales tax rate for Pinellas County Florida is.

Pinellas County Puerto Rico has a maximum sales tax rate of 75 and an approximate population of 724022. The Clerk of the Circuit Court and Comptroller is the County Recorder responsible for recording all recordable documents into the Official Records of Pinellas County Florida. The current total local sales tax rate in Pinellas County FL is 7000.

This Tax Estimator is based on the following assumptions. Sales tax in Pinellas County Florida is currently 7. S Florida State Sales Tax Rate 6 c County Sales Tax Rate.

Dont forget - pay in November for a 4 discount. L Local Sales Tax Rate. Assumes JustMarket Value at 89 of Purchase Price of Subject.

Our Pinellas County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax. A county-wide sales tax rate of 1 is applicable to localities in Pinellas County in addition to the 6 Florida sales tax. This is the total of state and county sales tax rates.

Pinellas County in Florida has a tax rate of 7 for 2022 this. The current total local sales tax rate in Pinellas County FL is 7000. Pinellas Park is located within Pinellas County.

Pinellas County in Florida has a tax rate of 7 for 2022 this. Update Address with the Property Appraiser.

Politifact Greenlight Pinellas Means A 300 Tax Increase No Tax For Tracks Says

Property Taxes Expected To Spike For New Homeowners

Florida Property Tax Calculator Smartasset

How To Calculate Fl Sales Tax On Rent

Hillsborough Could Have Florida S Highest Sales Tax After The Nov 6 Election Will It Matter

Pinellas County Florida Sales Tax Rate

Tampa Bay Counties Are Setting Their Property Tax Rates Here S What That Means For You Wusf Public Media

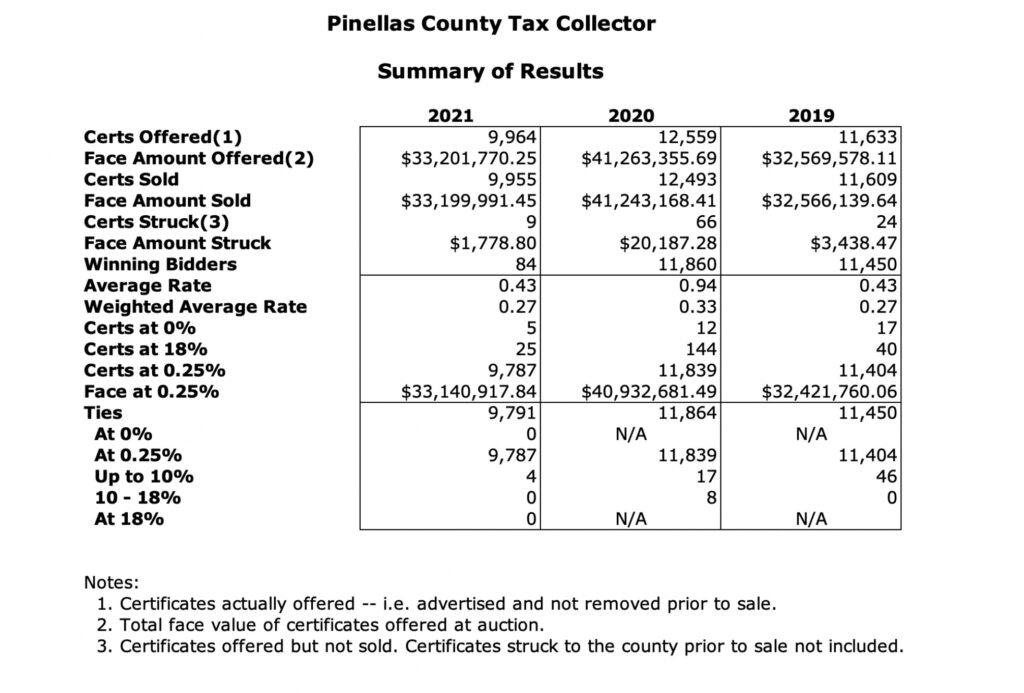

Tax Certificate And Tax Deed Sales Propertyonion

Florida Vehicle Sales Tax Fees Calculator

How To Register For Florida S Sales Use Tax

Pinellas County Fl Property Tax Getjerry Com

Florida Income Tax Calculator Smartasset

Florida Dept Of Revenue Property Tax Data Portal

Puerto Rico Sales Tax Rates By City County 2022

Cities With The Highest And Lowest Property Tax Rates In Pinellas County

Are You Able To Set Up Discretionary Sales Tax By County In Florida This Tax Is Only On The First 5000 Of The Item And Is In Addition To The 6 State